(

it's sure not shining here)

Yesterday, in a post titled

Adding Some Sun to Rain City Guide, Dustin Luther announced that he's joining the

Move (

formerly Homestore) team and will become their new Director of Consumer Innovations.

A few months ago, after a

$100 million cash infusion from private equity group

Elevation Partners was announced, Dustin

proposed a mission:

Imagine that you’ve been invited to 2800 Sand Hill Road to discuss the future of real estate with Roger McNamee, Fred Anderson, Bono, John Riccitiello, John Doerr, and Joe Hanauer.

What do you tell them? What features do you want to see in real estate search? If you are an agent, what is the biggest pain that someone could fix with a technical solution? If you are a buyer, what are the major gaps you see in the current system? What information do you wish you had?

I know that some of my readers have some great ideas. Please share as much as you’re willing. Remember that these guys want to work “within” the current system (i.e. cooperate with real estate agents!), and, most importantly, these people are thinking huge… $100M huge!

It looks like the folks from Homesto..err, make that Move hopped on the

Cluetrain and made an excellent choice in bringing Dustin aboard to help them achieve that mission.

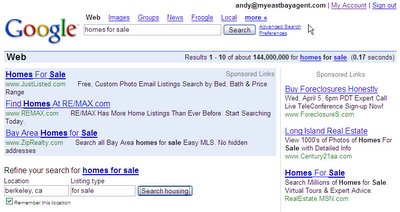

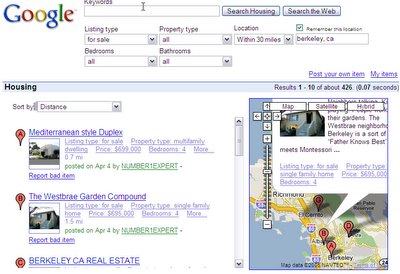

A big part of the coming evolution is the upcoming launch of move.com, which reportedly will include

A vertical search engine for new homes and rental units that, like Google, will “crawl” the Web looking for relevant content and display that content in algorithmically sorted search results.

The new engine replaces the existing search functions at Homebuilder.com and Rent.net, which limited results to paid providers.

The result of the beefed-up search capabilities will be a big increase in the number of results to consumers, making the search experience far more compelling, says Allan Merrill, Homestore’s executive vice president for strategy and corporate development.

The new Move.com has yet be to be launched, but with it's exclusive agreement with the NAR, it seems like they're in a unique position in the vertical real estate search game that could.(link)

Taking into account their already

strong ranking along with exclusive access to listings directly from the MLS, they look to be in a good position once Move.com finally does launch.

Once again, congratulations Dustin. Real Estate professionals across the nation should rest a bit easier knowing that we have people like you going to bat on our behalf.