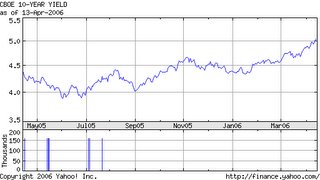

Breaking the 5% Barrier

Home buyers and sellers in the Bay Area this spring will be doing so in a climate where rates are the highest they've been in 4 years as the benchmark 10-year T note has broken the 5% barrier.

...consumers will soon be paying more interest on credit cards and home mortgages. The change will have the biggest impact on people who took out home loans with low introductory interest rates but adjust to higher rates in later years.

The average national 30-year fixed mortgage interest rate was 6.43 percent last week, up from 6.21 percent at the start of the year and 5.71 percent at the start of 2005. The introductory interest rate on a five-year adjustable-rate mortgage was up to 6.11 percent, from 5.78 percent in January and 5.3 percent a year ago.

For much of the last year, analysts and policy makers have been confounded by the United States' relative low long-term interest rates, given the Federal Reserve's campaign to push up interest rates by increasing its benchmark short-term rate, now at 4.75 percent. The Fed has signaled that it intends to raise its federal funds rate on overnight bank loans at least once more, to 5 percent, at its meeting next month.

Many experts believe longer-term interest rates in the United States have been kept low by the purchase of federal government debt by foreign governments and investors, particularly from Asia.

Keep paying attention to the 10 year note, its behavior will be cricical in how this current housing market plays out.

flickr photocredit for the sweet HDR shot to Automatt. Used under a Creative Commons License.

<< Home