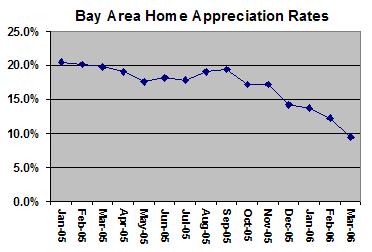

Bay Area Appreciation Continues to Slow

The latest Bay Area housing numbers from Dataquick are in and sales volume and appreciation rates are continuing their downward trend.

"March numbers are pretty good at predicting upcoming activity. We figure that sales will be good but not spectacular on into the summer and that price increases will stay below ten percent. We'll probably have a couple of months with new price peaks, but those new records will be reached at a slower rate of appreciation," said Marshall Prentice, DataQuick president.

The typical monthly mortgage payment that Bay Area buyers committed themselves to paying was $2,958 in March. That was up from $2,889 in February, and up from $2,636 for March a year ago. Adjusted for inflation, mortgage payments are 18 percent higher than they were at the peak of the prior cycle sixteen years ago.

What's interesting is that Berkeley seems to be insulated from the rest of the East Bay market. According to the latest data that my colleague Glen Bell just compiled, Berkeley's Pending/Active ratio has rebounded to .99 while the rest of the East Bay is stagnated in the .5 range. A higher ratio is indicative of a stronger sellers market.

Chart courtesy of DataQuick Information Systems, www.DQNews.com

<< Home